My answer will be: OTHER. Done. Put that in your algos & data mine it. 😛

All posts by Jefferson

House Approves Arms/Training for “Moderate” Syrian Rebels

This is what “bi”-partisanship (aka purple party) gets you… More war, more death, more debt, and more government. SMH. 🙁

Audit the Fed Passes House

This is a bit of hope, but Dirty Harry will kill it in the Senate. The Bankers will win this day. I wonder what those 90 Nays are thinking… “yeah, let’s just leave an unelected elite group of banksters free to print as much as they want & give it to whomever they want – that’s a plan”. 1913… the gift that keeps on giving.

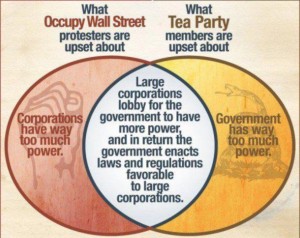

The Tea Party / Occupy Intersection

Been imagining this graphic in my mind for a long time now. Both are right on their diagnoses but Occupy is wrong on its solutions. If corporations have too much power, giving government even MOAR power does nothing to stop that – in fact it makes it worse – because government and corporations are in bed together. The solution is a return to a tru ly free market where corporations are allowed to fail, and government is limited and held accountable to any cronyism like picking winners and losers, providing bailouts & “gift loans”, no bid contracts to Halliburton/Monsanto and so forth. Power needs to go back where it belongs – to the people – not the government nor corporations, and that is done via restoring the free market, not the crony market we currently have run by central bankers who work for the 0.01%.

ly free market where corporations are allowed to fail, and government is limited and held accountable to any cronyism like picking winners and losers, providing bailouts & “gift loans”, no bid contracts to Halliburton/Monsanto and so forth. Power needs to go back where it belongs – to the people – not the government nor corporations, and that is done via restoring the free market, not the crony market we currently have run by central bankers who work for the 0.01%.

The Biggest Ponzi Scheme In The History Of The World

By: Michael T. Snyder

By: Michael T. Snyder

Did you know that you are involved in the most massive Ponzi scheme that has ever existed? To illustrate my point, allow me to tell you a little story. Once upon a time, there was a man named Sam. When he was younger, he had been a very principled young man that had worked incredibly hard and that had built a large number of tremendously successful businesses. He became fabulously wealthy and he accumulated far more gold than anyone else on the planet. But when he started to get a little older he forgot the values of his youth. He started making really bad decisions and some of his relatives started to take advantage of him. One particularly devious relative was a nephew named Fred. One day Fred approached his uncle Sam with a scheme that his friends the bankers had come up with. What happened next would change the course of Sam’s life forever.

Even though Sam was the wealthiest man in the world by far, Fred convinced Sam that he could have an even higher standard of living by going into a little bit of debt. In exchange for IOUs issued by his uncle Sam, Fred would give him paper notes that he printed off on his printing press. Since the paper notes would be backed by the gold that Sam was holding, everyone would consider them to be valuable. Sam could take those paper notes and spend them on whatever his heart desired. Uncle Sam started to do this, and he started to become addicted to all of the nice things that those paper notes would buy him.

Fred took the IOUs that he received from his uncle and he auctioned them off to the bankers. But there was a problem. The IOUs issued by Uncle Sam had to be paid back with interest. When the time came to pay back the IOUs, Uncle Sam could not afford to pay back the debts, pay the interest on those debts, and buy all of the nice things that he wanted. So Uncle Sam issued even more IOUs than before so that he could get enough notes to pay off his debts. As time rolled on, this pattern just kept on repeating. Uncle Sam repeatedly paid off his old debts by taking out even larger new debts.

Meanwhile, since the notes that Uncle Sam was using were backed by gold, everyone else in the world decided to start using them to trade with one another. This was greatly beneficial to Uncle Sam, because the rest of the world was glad to send him oil, home electronics, plastic trinkets and anything else that Uncle Sam wanted in exchange for his gold-backed notes.

Eventually, however, the rest of the world started to suspect that the number of gold-backed notes that Uncle Sam was issuing far exceeded the amount of gold that Uncle Sam actually had. So the rest of the world started to trade in their notes for gold.

And by that time Uncle Sam definitely did not have enough gold to back up his notes. Realizing that the scheme was starting to collapse, one day Uncle Sam announced that his notes would no longer be backed by gold. But he insisted that the rest of the world should continue using his notes because he was the wealthiest man on the planet and everyone should just trust him.

And the rest of the world did continue to trust him, although it wasn’t the same as before.

As Uncle Sam got greedier and greedier, he started to issue IOUs and spend notes at a rate that nobody ever dreamed possible. The great businesses that Uncle Sam had built when he was younger were starting to decline, and Uncle Sam started buying far more stuff from the rest of the world than they bought from him. The rest of the world was still glad to take Uncle Sam’s notes because they used them to trade with one another, but they started accumulating far more notes than they actually needed.

Not sure exactly what to do with mountains of these notes, the rest of the world started to loan them back to Uncle Sam. It eventually got to the point where Uncle Sam owed the rest of the world trillions of these notes. Even though the notes were losing value at a rate of close to 10 percent a year, Uncle Sam somehow convinced the rest of the world to loan him notes at an average rate of interest of less than 3 percent a year.

One day Uncle Sam woke up and realized that the amount of debt that he owed was now more than 5000 times larger than it was when Fred had first approached him with this ill-fated scheme. Uncle Sam now owed more than 16 trillion notes to his creditors, and Uncle Sam had already made future financial commitments of 202 trillion notes that he would never be able to pay. Meanwhile, the notes that Fred had been printing up for Uncle Sam were now worth less than 5 percent of their original value. Uncle Sam was becoming concerned because some of his other relatives were warning that this whole scheme was about to collapse.

Sadly, Uncle Sam did not listen to them. Uncle Sam knew that if he admitted how fraudulent the financial scheme was, the rest of the world would quit sending him all of the things that he needed in exchange for his notes and they would quit lending his notes back to him at super low interest rates.

And if the rest of the world lost confidence in his notes and quit using them, Uncle Sam knew that his standard of living would go way, way down. That was something that Uncle Sam could not bear to have happen.

When a financial crisis almost caused the scheme to crash in 2008, a desperate Uncle Sam went to Fred and asked for help. In response, Fred started printing up far more notes than ever before and started directly buying up large amounts of IOUs from Uncle Sam with the notes that he was creating out of thin air. Fred hoped that the rest of the world would not notice what he was doing.

It seemed to work for a little while, but then an even worse financial crisis came along. Once again, Uncle Sam started issuing massive amounts of new IOUs and Fred started printing up giant mountains of new notes to try to fix things, but their desperate attempts to keep the system going were to no avail. The rest of the world started to realize that they had been sucked into a massive Ponzi scheme, and they lost confidence in the notes that Uncle Sam was using. Suddenly nobody wanted to lend notes to Uncle Sam at super low interest rates anymore, and people started asking for far more notes in exchange for the things that Uncle Sam wanted.

Uncle Sam’s standard of living dropped dramatically. Since he could no longer flood the world with his notes, Uncle Sam could not continue to consume far, far more wealth than he produced. Uncle Sam sunk into a deep depression as he watched the scheme fall apart all around him.

Uncle Sam had once been the wealthiest man on the entire planet, but now he was a broke, tired old man that was absolutely drowning in debt. Unfortunately, once he was down on his luck the rest of the world did not have any compassion for him. In fact, much of the rest of the world celebrated the downfall of Uncle Sam.

All of this could have been avoided if Uncle Sam had never agreed to Fred’s crazy scheme. And once Uncle Sam made the decision to stop backing his notes with gold, it was only a matter of time before the scheme was going to collapse.

Does this little story sound crazy to you? It shouldn’t. The truth is that you are involved in such a scheme right now. In case you haven’t figured it out, “Uncle Sam” is the United States, the “notes” are U.S. dollars, and “Fred” is the Federal Reserve.

Please share this story with as many people as you can. Our country is headed for complete and total financial disaster, and we need to get people educated about this while there is still time.

“Risk-Free” Is So 2012

by John Rubino on March 25, 2013

So you’ve got this pile of cash and you’re not sure what to do with it. Nice problem, as problems go, but definitely not trivial, especially if you’re more concerned with keeping what you have than trying to make it grow.

Time was when you could simply deposit a few hundred thousand dollars or euros in your bank and relax, secure in the knowledge that even though your balance was above your country’s deposit insurance coverage limit, it was still pretty safe because your bank was, well, your bank. And no one loses money on a bank account. Even in the darkest days of the 2009 financial crisis, account holders at Citigroup and JPMorgan Chase were never seriously threatened.

That pleasant delusion ended on Sunday night when the EU forced tiny, previously insignificant Cyprus to charge large depositors for the cost of bailing out its overextended banking system – and eurozone officials hailed the plan as a template for future crises. As Britain’s Economist Magazine put it:

Coming soon to uninsured deposits near you

ON THE subject of euro zone fragility and the impact of the Cyprus incident on broader confidence in the single currency, an exhibit. Fresh off negotiating the Cyprus deal Jeroen Dijsselbloem, the Dutch finance minister and head of the “Eurogroup” of euro-zone finance ministers, said in comments to Reuters and the Financial Times that:A rescue programme agreed for Cyprus on Monday represents a new template for resolving euro zone banking problems and other countries may have to restructure their banking sectors…

In other words, Cyprus is absolutely a unique case, BUT if trouble should come to banking sectors elsewhere in the euro zone hitting uninsured depositors would seem a sensible way to go. Alternatively: rich Spaniards, Italians and so on should perhaps think about moving money in excess of deposit guarantee limits elsewhere.

And with that, equities flipped from positive to negative on the day, and European bank stocks tumbled. It could just be that traders are antsy today. But euro-zone officials should at least consider the possibility that the barrier holding back a raging contagion from Cyprus might not be particularly thick.

At any rate, one has to respect the European commitment to ensuring journalists don’t put too positive a spin on things.

Some thoughts

The Cyprus saga contains at least two broadly-applicable lessons: First, by initially going after all bank accounts rather than just those large enough to be uninsured, Europe’s leaders gave a rare glimpse of how they really feel about private property, which is that it’s only private until the state needs it. That they backtracked in the face of public outrage (and the prospect of continent-wide bank runs) doesn’t change the fact that they’d have done it if they could have gotten away with it. Second, the revised “template,” by sparing small accounts, puts an even heavier burden on large accounts, which in some cases might be wiped out like any other unsecured creditor of a failed borrower.

So we’re left with a very different sense of what it means to have money in the bank. Small savers now know that their government will take their accounts if some future crisis makes it politically feasible. Large depositors now know that they’re unsecured creditors of extremely shaky institutions. In other words, a bank account yielding 1% is actually both riskier and lower-yielding than a portfolio of dividend paying stocks – or even a portfolio of junk bonds.

This turns the traditional risk/reward calculus on its head. Which, make no mistake, is a good outcome for the world’s governments and central banks. Cutting interest rates to zero and aggressively lowering the value of the dollar, euro and yen are intended to cause savers to become investors and investors to become speculators. The further out we all move on the risk spectrum the greater the chance that the old, indebted economies will “grow” through the next election cycle.

But turning savers and retirees into growth stock and junk bond investors means that the next 30% stock market correction (now long overdue based on charts like these) will be catastrophic for people who actually need their money. Meanwhile, in the bubbly here-and-now the same process will starve even well-run banks of deposits, since their CDs and savings accounts are now high-risk/low-return and thus not worth the trouble. The near-certain result: more banks will need bailouts, more savers will be expropriated, and more money will migrate towards risk.

The other unintended consequence of all this is — does it even have to be said? — a migration out of paper and into real assets. If there was ever a time to load up on physical gold and silver, this is it.

The Coming Debt Limit Drama: Government Wins, We Lose

By: Ron Paul

Last week President Obama bluntly warned Congress that he will not negotiate when it comes to raising the statutory debt limit. If Republicans attempt to use a debt ceiling vote to win concessions on spending from the White House, Mr. Obama threatens simply to raise the limit by executive order or other unilateral action.

This is business as usual in Washington. Democrats literally do not believe we have a deficit and debt problem, and reliably propose greater borrowing and spending. Republicans talk a good game when it comes to government debt, but have no credibility to argue against deficits or abuses of executive power. Brinksmanship ensues, and ugly compromises are reached at the 11th hour. We all lose as the endless borrowing and money printing further erode our dollar and our economy.

Keep in mind that the federal government relentlessly spends about $100 billion more each month than it collects in taxes. This means roughly 40% of every dollar Washington spends is borrowed, to be “paid back” only in highly devalued, newly created money. Ultimately this can only lead to the destruction of the US dollar, as history plainly teaches. But in the face of this reality Obama just shrugs, turning to demagoguery and talk of little old ladies’ Social Security checks . Like Obama, far too many Americans view federal debt as a nonissue. Consider Paul Krugman, America’s most reliable Keynesian economist and a beloved figure among mainstream journalists. He recently wrote an article about the debt limit issue, in which he discussed a controversial proposal to have the federal government simply create a platinum coin with a face value of $1 trillion:

“Here’s how it would work: The Treasury would mint a platinum coin with a face value of $1 trillion (or many coins with smaller values; it doesn’t really matter). This coin would immediately be deposited at the Federal Reserve, which would credit the sum to the government’s account. And the government could then write checks against that account, continuing normal operations without issuing new debt.”

To be fair, Mr. Krugman acknowledges that minting such a coin would be an accounting “trick,” but he is dead serious about this option for the Obama administration. This then is the state of modern economics discourse in America, where a respected New York Times economist literally can propose creating “money for nothing” and have the idea taken seriously.Krugman’s suggestion is just another variant of the endless stimulus proposals, which purport to create greater aggregate demand in the economy by creating more money. Whether this is done by the Fed or the Treasury is of little importance, as long as government is creating demand-side “growth,” however artificial.

But in just a few short sentences Professor Hans-Hermann Hoppe eviscerates the Krugmans of the world by pointing out the obvious: If governments or central banks really can create wealth simply by creating money, why does poverty exist anywhere on earth? Why haven’t successive rounds of quantitative easing by the US Fed solved our economic recession? And if Fed money creation really works, and doesn’t create inflation, why haven’t Americans gotten richer as the money supply has grown?

The truth is obvious to everyone. Fiat currency is not wealth, and the creation of more fiat dollars does not mean that more rice, steel, soybeans, Ipads, or Honda Accords suddenly come into existence. The creation of new fiat currency simply strengthens a fantasy balance sheet, either by adding to cash reserves or servicing debt. But this balance sheet wealth is an illusion, just as the notion we can continue to raise the debt limit and borrow money forever is an illusion.